MULTI LEVEL MARKETING (MLM), PONZI SCHEMES AND PYRAMID SCHEMES

MLM, PONZI SCHEMES AND PYRAMID SCHEMES

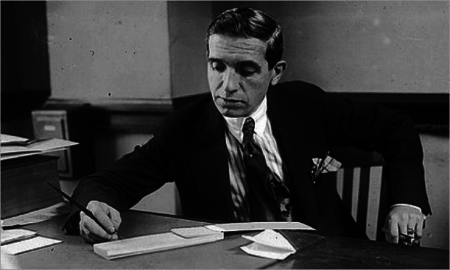

Named after Charles Ponzi, who ran his scam from 1919-1920, the Ponzi scheme is a fraudulent investment plan. In a Ponzi scheme, the crooks (“Perpetrator”) take money as an “investment”. The Perpetrator’s running the Ponzi scheme may or may not tell investors how their returns on investment will be generated, but always promise a favorable and guaranteed return – one that will get you rich fast and without a lot of risk or effort.

Internet and financial transaction advancements has resulted in a proliferation of investment fraud schemes. In the last 10 years the percent of the Securities Exchange Commissions Ponzi scheme focused activities has increased from less than ten (10%) percent of their focus to nearly fifty percent (50%). Financial Fraud has become a lucrative boutique crime. Financial transaction criminals are as smooth as silk, have a successful “scam” playbook to draw from, and know exactly how to take advantage of electronic communication and currency transfers.

The typical Ponzi scheme runs one to two (1-2) years and frequently across international borders. The promised interest rate or returns on investment in these Ponzi schemes are always in an amount high enough to be worthwhile to the investor but not so high as to be unbelievable. This is called an “above normal rate of return on investment”.

Financial fraud predators quickly amass staggering illegal profits from victims across broad geographic areas and demographic groups and then when they are shut down by law enforcement – they move to a different country or open up spin offs under different names. When the Perpetrators are jailed, others quickly seize upon the victims with the offer of a new investment opportunity. Many are so desperate that they again fall into copycat Ponzi scheme.

The damage the TELEXFREE scheme has done to hundreds of thousands of hardworking families and individuals has brought some attention to the dangers of Ponzi and Pyramid schemes. The TELEXFREE fallout makes clear what will happen to you or your family if you fall for and participate in a “get rich scheme”.

Brazilian authorities that found TelexFree was running an illegal pyramid scheme shut them down. After their Brazilian operation was shut down, they simply opened up shop in the United States and in other countries. To brush aside the Brazilian shut down and to assure future investors that they were a legitimate business, TelexFree ran a convincing public relations campaign that was made up of statements and opinions that were either entirely false, taken out of context, deceptive or misleading. As a result, almost a million additional United States based families fell victim to their Pyramid scheme.

PONZI SCHEME VERSUS PYRAMID SCHEME

A common misperception is that all Ponzi schemes are pyramid schemes. Ponzi schemes and pyramid schemes are similar. Both are based on using new investor funds to pay the Perpetrator and occasionally, earlier investors. In a Pyramid scheme, money is paid out according to an organized hierarchy and the scam artists promote the proposition that each investor will reap direct and great benefit depending on how many new investors are recruited by them or those who they in turn recruit. Whether a Ponzi or a Pyramid scheme, eventually there isn’t enough money to go around and the in investors lose.

PONZI SCHEME WARNING SIGNS

Ponzi schemes are effective and one of the most common rip off schemes presently being used by international thieves and organized crime. For a sophisticated or experienced Multi Level Marketing veteran or thief, a Ponzi scheme is a straight forward scam to carry out. They typically follow a similar protocol that has overtime proven to be effective. Be on the lookout for the following standard characteristics and avoid businesses that have even one. Behind their banks, Investors in Ponzi schemes are called “marks”, “dupes” or “suckers”. Investors in Pyramid and Ponzi schemes always end up as victims.

To operate a Ponzi scheme scam artists will typically make use of the following:

- The Hook – Above Normal Rate or Guaranteed Return on Investment Will Be Offered: In a Ponzi scheme, potential investors are promised that an investment opportunity that will:

- give the investor an above normal, higher than available through regular investment opportunities, rate of return. For example, if you invest $100.00 you can expect $25 back soon. In a Ponzi scheme, the interest rate or return on investment is often specified or it’s very easy to figure out. In TelexFree it was in excess of 200% in the first year.

- guarantee a return on investment, usually within months in exchange for little work or risk.

- Credibility Shower – Lawyers, CPA’s Professionals, and Investors Who Became Rich Overnight Will Endorse the Scam: The victims of Ponzi schemes are always given a believable explanation of how their investment will earn the “above normal rate of return on investment”. The explanation thy give must be good enough to convince people to invest and reinvest their money and importantly, to recruit others. The Perpetrators put a great deal of effort into this and often retain licensed professionals and recruit seasoned Multi Level Marketing scamsters.

Most often Ponzi scheme Perpetrators will hire lawyers or Certified Public Accountants or other credible professionals to bless the scam as a legal and sound business opportunity. They will often have other credible persons advise potential investors that this is an incredibly great opportunity that worked for them including so called regular people who have “gotten rich quick”.

In the TelexFree scam, the owners used lawyers, Certified Public Accountants and later Multi Level Marketing professionals with great experience or success to state the scam was legal and that it was a good investment. The lawyers, CPA’s and other professionals vouched for the scam in exchange for payoffs.

TelexFree paid CPA Joe Craft $1.93 million dollars between June 24, 2013 and March 14, 2014 and his trust another $371,889. They also paid lawyer Gerald Nehru who endorsed the TelexFree Pyramid scheme as legal during a “Super weekend” held in a fancy hotel in Newport Beach, California about a month after TelexFree was shut down in Brazil. His opinion was put up on the web and used by TelexFree as a marketing tool. In addition to other lawyers and consultants, TelexFree also made ample use of individuals who purportedly got rich quick and “fulfilled their dreams” or bought new cars, boats, and houses.

Another typical characteristic of a Ponzi scheme “Credibility Shower” is the promotion of specialized experience and education, or a unique and desirable product. Many times the founders or those running the company operating the Ponzi Scheme are described as being highly successful, skilled, trained or educated and the product as “ground breaking”.

TelexFree’s owners boasted on their web site that they were college graduates with specialty degrees in a field related to the product they tout as driving the profit. They did not graduate from college and were college dropouts. The owners also advertised they had experience in telecommunications. The only experience they had was a failed company and a company shut down by authorities as an unlawful Pyramid scheme. TelexFree’s owners also described TelexFree’s VoIP product as groundbreaking new technology. TelexFree’s VOIP was not as good as what was available for free from Google Voice or Skype.

Inside Information is another frequent reason used to support the specified “above normal rate of return”. Persons involved in the investment opportunity will claim to have “inside information” or “access to an investment opportunity not available to the general public”.

The possibilities are as endless as the imaginations of the scam artists who victimize hard working people.

- Initial Investors Paid Off: In many Ponzi schemes some initial investors will receive the promised return. In large scale Ponzi Schemes, like TelexFree, many will begin to realize a similar rate of return. This is a calculated tactic used to convince victims that the investment is not risky, and that a return will be received. The $100 dollar investor into a $1,000 or $10,000 investor. The Perpetrators use the smaller payouts to bring in bigger investments!

Ponzi Schemes succeed because the majority of victims invest over and over with larger amounts of cash. They also recommend others because the scam provides them with Payouts early on. The Payouts are successful in motivating investors to bring in the investment cash of their family, friends, co-workers and others.

Many of our TelexFree clients initially invested small sums and then after receiving the above normal rate of return on investment” invested a great deal more. Many more convinced their family and friends to invest. Some of our clients took out loans on their homes and others emptied their savings accounts.

Once enough money is received to achieve the crooks financial goals or government officials shut them down, the victim’s investments vanish.

Our TelexFree clients who took out loans are paying back what they borrowed plus interest. Our TelexFree clients who drained their savings accounts lost everything they earned over a lifetime.

- Communicated Successes: As referenced above, Ponzi scheme Perpetrators will heavily promote success stories and build in a system that makes it profitable for investors to communicate the historical success of the investment opportunity. Historically, the most damaging Ponzi schemes have put victims in a position where they believed convincing their family, friends and others close to them to invest money into the scam was doing them a great favor.

Investors and potential investors are characteristically exposed to testimonials describing big payoffs and motivating success stories. Insiders or investors who are in in the scam are often posed as MLM “Rock Star’s”. Once given Rock Star status they promote the promised above normal rate of return on investment, often with great deal of flourish including visuals of the riches they have reaped.

In larger Ponzi Schemes meetings at hotels or exotic locations are common. It is also common for success stories to involve tales of great income, early retirement or other dreams come true. Spokes persons often sport expensive clothes and jewelry, drive nice cars or boats, and live in nice houses. They often pay for these luxuries with the investment monies of their victims. Occasionally “shills” are ordinary people who offer supporting testimonials scripted by the Perpetrators. They are criminal actors and actresses.

In addition to lending credibility to the scam, they set the bar that the average investors can reach and offer encouragement to borrow money or drain life savings.

The money taken in by the Ponzi Scheme needs to grow and at the very least, more money needs to be coming in than is equal to the commissions or other returns on investment being paid back to investors. As long as the investment income paid in exceeds the interest rate payments or returns that must be paid out the Ponzi Scheme remains very profitable to the scam artists. That is why they will repeat steps 1 through 3 a number of times.

Ponzi Schemes always collapse. Without warning at some point however, the Perpetrators will not return the investment money or pay the promised return. Instead they will seek to escape with the money by declaring bankruptcy disappear and starting a new life, or the company will be raided. One TelexFree founder Carlos Wanzeler is presently hiding in Brazil with tens of millions of his victim’s dollars. His wife Katia Wanzeler was caught red handed trying to flee the country with cash. His handpicked Certified Public Accountant Joe Craft was also caught red handed during a FBI/Homeland Security raid with over $30 million dollars in bank checks and the data.

MORE PONZI SCHEME RED FLAGS

Before participating in or recommending that your friends, family or contacts joining in on any get rich offer make sure none of these pyramid scheme red flags are present:

RED FLAG 1 – Emphasis on recruiting. If a get rich quick offer emphases recruiting others – a Pyramid scheme red flag is waiving. If you are guaranteed you will receive more compensation for recruiting others than for product sales – run do not walk from the offer. Always demand to see in writing how much revenue was brought in by the company through product sales and how much through the recruitment of additional promoters.

RED FLAG 2 – Promise of above normal rate of return on investment in a short time period. High returns and fast cash typically a mean that commissions are being paid out of money from new recruits rather than revenue generated by product sales. Walk from get rich quick offers that promise above normal rate of return on investment in a short time period.

RED FLAG 3 – Easy money or passive income. Walk from get rich quick offers that promise compensation in exchange for little work such as cutting and pasting internet ads, recruiting others, making payments or doing nothing. For example, TelexFree uniformly and systematically did not require Promoters to sell its VoIP product to qualify for payments prior to March 9, 2014. The only actual product offered is the memberships sold.

RED FLAG 4 – No objectively provable profit from retail sales. Walk from get rich quick offers where you are not quickly and painlessly provided with a provable profit from retail sales. Legitimate businesses have this sort of data easily accessible and in form that is documented in mandatory government filings because this is the only legal way for them to operate or it is the major selling point they will have to grow through new participants. Demand to see documentation for the facts and particulars they advance to entice you to participate. Demand to see the related government filings for any answer offer. Demand a random list of customers who used the company’s product or service and to talk to them about their experience. Try the product or service yourself for free prior to investing a dime.

RED FLAG 5 – Buy-in required. Walk from get rich quick offers where you are required to pay a buy-in to participate in the program, even if the buy-in is a nominal one-time or recurring fee. Ponzi schemes profit from memberships and buy ins, not from the sale of product or services of value.

RED FLAG 6 – Complex payment structure. Walk from get rich quick offers that have complex commission structures standing alone or that come with a promise above normal rate of return on your investment in a short time period Walk from get rich quick offers that unless your earnings are solely or at least primarily based on products or services that you or your recruits sell to people outside the program. Walk from get rich quick offers where you do not understand how you will be compensated and why.

RED FLAG 7 – No product or service that is of any real value. This is the hardest red flag to identify because Scam Artists devote a great deal of effort and attention to selling their victims a false product. TelexFree for example offered a Voice Over Internet telephone service. Always research in great detail all products or services that are offered in program offers that have any of the other red flags waiving. Walk away if the underlying product or service being sold to others is the same as other similar offerings, is the same as other offerings but has a novelty of unproven value and reliability added, is otherwise speculative, or is offered at a price that is not in line with other similar offerings.

WHAT IS A PYRAMID SCHEME?

The classic “pyramid” scheme makes money for those at the top and less than a handful of others. Those who profit from Pyramid schemes do not retain their profits because private class actions or government prosecutions or both seize related profits and accumulated personal assets for the benefit of the victims. Pyramid schemes make money by recruiting new participants into the program, not by sales of a product or program that has real value. All pyramid schemes promise of above normal rate of return on investment returns in a short period of time for doing nothing other than handing over your money and getting others to do the same.

Scam Artists behind a pyramid scheme may go to great lengths to make the program look like a legitimate multi-level marketing program. An all out effort is placed into the appearance of legitimacy because that is the key to a successful pyramid type Ponzi scam. One of the best-known examples of a pyramid scheme was run by disgraced investor Bernie Madoff, who was arrested in 2008 after losing some $50 billion of his investor’s funds.

The absence of a real product or service of value is a fatal flaw and simple math makes clear that eventually all pyramid schemes collapse. Sometimes pyramid schemes get too big, and the promoter cannot raise enough money from new investors to pay earlier investors, and many people lose their money. Other times government enforcement forcefully closes the scam.

LINKS TO WORST PONZI AND PYRAMID SCHEMES

The following are links to list of the worst Ponzi and Pyramids schemes to date that were created before TelexFree scam was discovered and stopped: